Opening a Demat account is one of the first steps to begin trading in the stock market. With the rise of online platforms, investors now have access to multiple online share market app, simplifying the trading experience. However, it is essential to understand a few key factors before proceeding. In this guide, we will walk you through everything you need to know before opening a Demat account.

What Does a Demat Account Do?

A Demat account, short for “Dematerialized account,” is a digital repository that holds your shares, bonds, and other securities in an electronic format. Unlike traditional physical certificates, which could be easily misplaced or damaged, the Demat account offers a secure way to store these assets electronically. A Demat account is essential for anyone interested in trading or investing in the stock market, as it helps facilitate seamless transactions..

Why Do You Need a Demat Account?

The primary purpose of a Demat account is to hold your financial assets in a secure, digital format. When you buy or sell stocks, your securities are transferred to or from your Demat account. Without this account, you cannot participate in the online share market.

Here are the key reasons you need a Demat account:

- Convenience: A Demat account eliminates the need for physical paperwork, making transactions quicker and easier. You can buy and sell stocks directly from your mobile or desktop, using an online share market app.

- Security: With the Demat account, your securities are safe from physical loss, theft, or damage. You can easily track the performance of your assets through a secure platform.

- Streamlined Transactions: Buying and selling stocks has never been easier with a Demat account. The process of transferring securities during trades is automated, reducing the chances of errors and delays.

- Cost-Effective: In many cases, opening and maintaining a Demat account can be inexpensive. Many platforms offer low fees for the management of your assets, making it a cost-effective way to start trading.

Key Features to Look for in an Online Share Market App

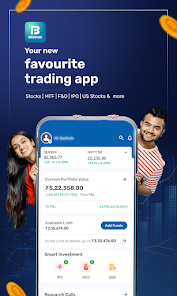

When opening a Demat account, one of the most crucial aspects to consider is the online share market app through which you will manage your trading activities. Here are a few features that can enhance your trading experience:

1. User-Friendly Interface

A top online share market app should have a simple, intuitive interface. This ensures that even beginner investors can navigate through it with ease. Look for apps that provide a clean, easy-to-read layout with clear charts and dashboards that display your stock performance.

2. Real-Time Market Data

Access to live market data is crucial for any investor. Whether you are a short-term trader or a long-term investor, real-time stock price updates help you make informed decisions quickly. Ensure that the platform offers accurate, timely information that can help you react to market movements instantly.

3. Security Features

Given the sensitive nature of financial transactions, it is essential that the app you choose employs robust security measures. Look for apps that offer features such as two-factor authentication, end-to-end encryption, and strong account recovery processes to protect your investments.

4. Easy Fund Transfer Options

Transferring funds between your bank account and your Demat account should be seamless. Look for apps that offer easy-to-use payment gateways and multiple funding options, such as net banking, UPI, or even wallet payments.

5. Research and Analysis Tools

Most top online share market apps come with built-in research tools that allow users to analyze stocks, industries, and market trends. Before choosing a platform, check if it offers features like historical data analysis, technical charts, and financial news to help you make data-driven decisions.

Types of Demat Accounts

There are different types of Demat accounts based on your needs. Each account type has unique features and functions, and selecting the right one is crucial for your trading success. Here’s a look at the most common types:

1. Regular Demat Account

This is the most commonly used type of Demat account for individual investors. It is used to hold and trade stocks, bonds, mutual funds, and other securities. This type of account is suitable for individuals who are actively participating in the stock market.

2. Repatriable Demat Account

A repatriable Demat account is for Non-Resident Indians (NRIs) who wish to trade in Indian securities. This type of account allows the transfer of funds from India to the NRI’s country of residence.

3. Non-Repatriable Demat Account

This account type is also designed for NRIs but restricts the movement of funds to their home country. NRIs holding this account cannot transfer funds back to their country of residence.

4. Corporate Demat Account

This type of account is designed for businesses or institutions that want to hold shares in a dematerialized format. Corporate Demat accounts come with additional features, such as the ability to manage multiple user accounts under one umbrella.

How to Open a Demat Account?

The process of opening a Demat account is relatively simple and can usually be done online. Below are the general steps to follow:

- Choose a Depository Participant (DP): A DP is an intermediary between you and the depository. They offer the platform where your Demat account will be held. Choose a DP with a reliable online share market app for easy management.

- Submit Documents: To open a Demat account, you will need to provide certain documents like your PAN card, address proof, and passport-sized photographs. Some platforms also ask for an income proof.

- Fill the Application Form: Complete the online or offline application form provided by the DP. This form will ask for your basic personal details and preferences.

- Sign the Agreement: You will need to sign an agreement with your DP, agreeing to the terms and conditions of the account management and trading services.

- Verification: Once all documents and forms are submitted, the DP will verify your details. After successful verification, your Demat account will be activated.

Fees and Charges Associated with a Demat Account

While opening and maintaining a Demat account is generally inexpensive, there are a few charges you should be aware of:

- Account Opening Fees: Many platforms offer free account opening, but some may charge a nominal fee.

- Annual Maintenance Charges (AMC): This fee is levied yearly for maintaining your account.

- Transaction Charges: Some platforms charge fees based on the number of transactions you perform or the value of your trade.

- Dematerialization Charges: If you want to convert physical shares to electronic form, some platforms charge a fee for this service.

Final Thoughts: Choosing the Right Demat Account

Before opening a Demat account, it’s important to assess your needs and goals. Select an online share market app that aligns with your investment strategy and provides all the tools necessary for informed decision-making.

Consider factors like user interface, security, fees, and customer service when making your choice. A good Demat account should provide seamless integration with your trading habits and allow for easy management of your investments.

Opening a Demat account can be a significant step in your financial journey. Make sure to understand the key features of the account, the platform you choose, and the costs associated with it. By selecting the right online share market app, you can enjoy a hassle-free trading experience and grow your investments securely.